AYLA AI Capital establishes a sustainable circular ecosystem in which profits generated from AI-driven fund operations are reinvested into the AYLA platform, used to incubate promising enterprises, and ultimately expand overall fund value.

This structure connects retail investors, institutional capital, and platform businesses into a single unified cycle, realizing an integrated growth model that combines AI, capital, and data.

R&D Lab (Fund Operations Research Center)

The AYLA Capital R&D Lab continuously advances AI models and risk-management engines, generating independent revenue through algorithm licensing and API sales.

It functions as a self-sustaining research institution that powers AYLA’s technological competitiveness.

Circular Revenue Structure

AYLA operates a four-layer revenue loop—Trading Income → Platform Revenue → Incubation Dividends → Fund Reinvestment—creating a sustainable and self-reinforcing growth model across its ecosystem.

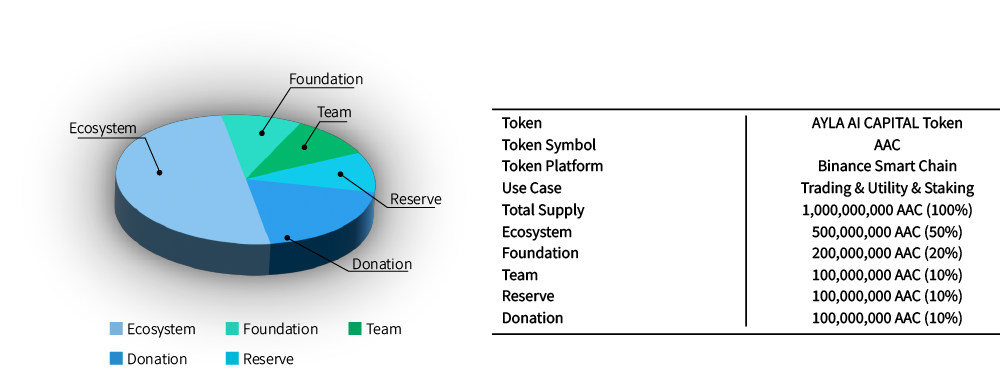

Utility-Based Token Economy (AAC Token Economy)

The AAC token functions as a real-world utility asset enabling payments, investments, rewards, and staking within the ecosystem.

Its value grows in proportion to fund performance and platform activity, positioning AAC as the core financial medium that links users, capital, and innovation.